24+ taxes mortgage interest

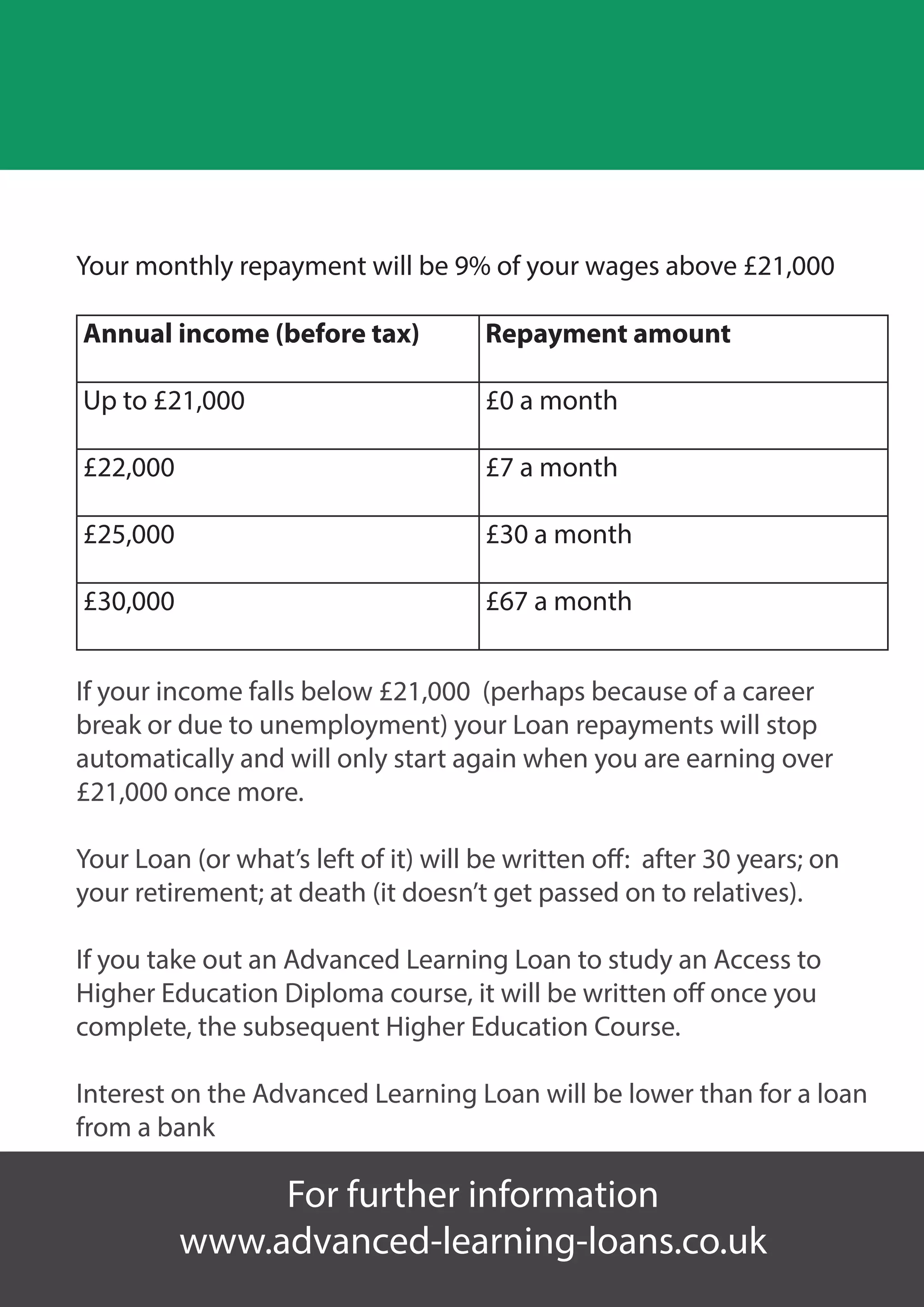

Ad Discover the Registered Owner Estimated Land Value Mortgage Information. 16 2017 then its tax-deductible on mortgages.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

You dont have to pay your taxes in April with an extension.

. Find All The Record Information You Need Here. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. In effect the government is paying homeowners to take on.

Web How to claim the mortgage interest tax deduction. Web At a personal tax rate of 24 this implies tax savings of 3566 in just the first year of the mortgage. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web If your home was purchased before Dec. Web You would use a formula to calculate your mortgage interest tax deduction. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

You can complete Form 1096 which is a transmittal and Form 1099-INT required when interest. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. For tax years before 2018 you can also.

Web Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file. Ad File 1040ez Free today for a faster refund. VA Loan Expertise and Personal Service.

Web Todays Mortgage Rates. Homeowners who bought houses before. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. These expenses can be. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. To put this into perspective Ramsey explains that if you take home 5000 per month after taxes according to his 25 rule you should pay no more than 1250 per month for a mortgage payment and that includes the principal payment property taxes. 31 each year and.

Web Myth No. Contact a Loan Specialist. Use Form 1098 to report.

Compare More Than Just Rates. Unsure Of The Value Of Your Property. Web And the only way to do that is to understand your home-buying budget and stick to it.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Lets say you paid 10000 in mortgage interest and are. However higher limitations 1 million 500000 if married.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web IRS Publication 936. If youre considering filing for a tax extension because you want to avoid paying the IRS.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web If youve closed on a mortgage on or after Jan. Companies are required by law to send W-2 forms to employees by Jan.

Find A Lender That Offers Great Service. Web Most homeowners can deduct all of their mortgage interest. At the same time the 15-year fixed.

Web Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage-related expenses paid on a mortgage during the tax year. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Get Your Quote Today.

Seller financed interest is taxable income to the recipient. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. The average APR fell on a 30-year fixed mortgage today slipping to 699 from 710.

But with a bi-weekly mortgage you would. To deduct mortgage interest you need to fill out line 8a on Schedule A IRS Form 1040 or 1040-SR using.

Document

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Mortgage Interest Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

24 Advanced Learning Loans From Pathway Group Birmingham

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

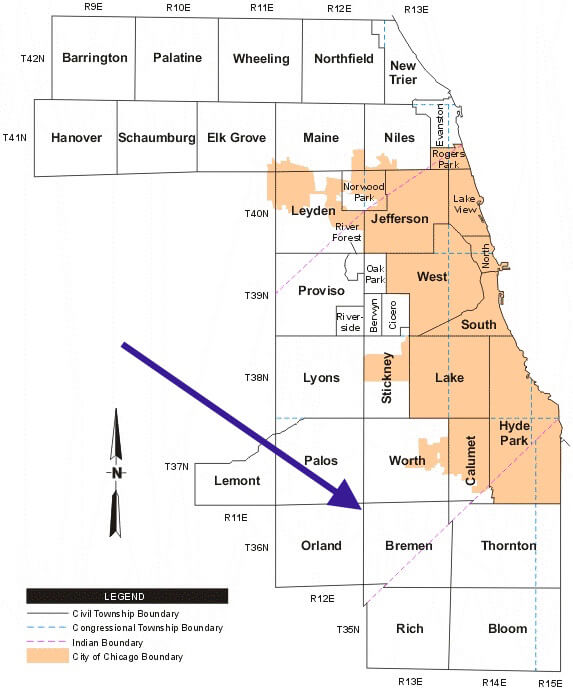

Suicidal Property Tax Rates And The Collapse Of Chicago S South Suburbs Wp Original Wirepoints

Mortgage Interest Deduction Rules Limits For 2023

The Home Mortgage Interest Deduction Lendingtree

Deduction Of Interest On Housing Loan Section 24b Taxadda

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Bankrate

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

Exhibit

Maximum Mortgage Tax Deduction Benefit Depends On Income